Another piece of the puzzle regarding what happened to the American Middle Class.

Capitalism: A Love Story

A 2009 American documentary film directed, written, and starring Michael Moore.

The film centers on the late 2000s financial crisis and the recovery stimulus, while putting forward an indictment of the current economic order in the United States and capitalism in general.

Topics covered include Wall Street's "casino mentality," for-profit prisons, Goldman Sachs' influence in Washington, D.C., the poverty-level wages of many workers, the large wave of home foreclosures, corporate-owned life insurance, and

the consequences of "runaway greed."

The film also features a religious component where Moore examines whether or not capitalism is a sin and whether Jesus would be a capitalist, in order to shine light on the ideological contradictions among evangelical conservatives who support free market ideals.

The film was widely released to the public in the United States and Canada on October 2, 2009.

Reviews were generally positive.

It was released on DVD and Blu-ray on March 9, 2010.

The film begins with a series of security footages of armed bank robberies (one of the robbers was on a crutch) accompanied by the song Louie, Louie.

Moore then uses an Encyclopædia Britannica archive video to compare and view modern-day America with the Roman Empire, by juxtaposing depictions of the fall of the Roman Empire with similar modern-day American issues.

The film then depicts home videos of families being evicted from their homes, as well as the "Condo Vultures," a Florida real estate agency whose business flourished with the increasing number of foreclosures.

The film then cuts back to the past "golden days" of American capitalism following World War II, followed by a "bummer" speech by President Jimmy Carter warning Americans of the dangers of worshiping "self-indulgence and consumption".

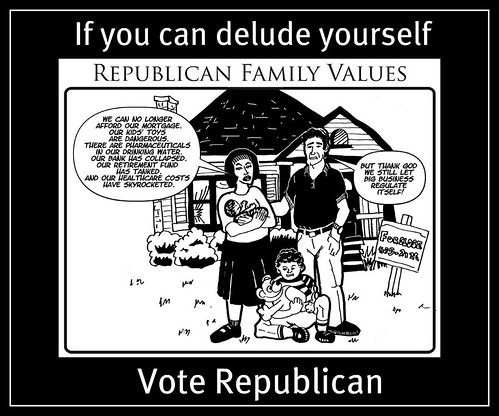

In the following Ronald Reagan years where the policies of Don Regan "turned the bull loose" for free enterprises, corporations gained more political power, unions were weakened, and socioeconomic gaps were widened.

Moore suggests that Reagan was favored for his charisma and communication skills rather than effective leadership, and highlights one of Reagan's speeches in which Regan, somewhat indiscreetly, orders Reagan to "speed it up," and Reagan quickly obeys.

The film then cuts to the kids for cash scandal, Captain Chesley Sullenberger's congressional testimony regarding airline pilots' poor treatment, and coverage of corporate-owned life insurance policies, where companies such as

Wal-Mart have insurance against losses caused when workers or suppliers die.

Moore then interviews several Catholic priests, including Bishop Thomas Gumbleton (Archdiocese of Detroit), all of whom

consider capitalism a "radical evil" contrary to the teachings of Christianity.

The film then presents a parody of what would happen if Jesus were a capitalist who wanted to "maximize profits," "deregulate the banking industry," and wanted the sick to "pay out of pocket" for their "pre-existing condition" (via clips from the 1977 miniseries Jesus of Nazareth), in contrast to the claims of several news pundits who proclaim the success of various capitalist enterprises as being a "blessing from God."

After referring to Dr. Jonas Salk, who for the public good, selflessly refused to patent the polio vaccine (asking, "Could you patent the sun?"),

Moore wonders about how the brightest of America's young generation are attracted into finance instead of science.

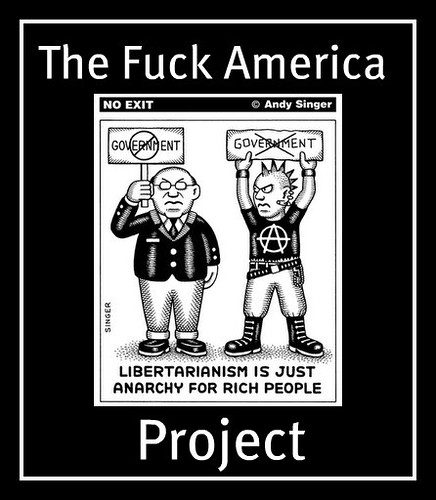

Moore then goes to Wall Street seeking technical explanation about derivatives and credit default swaps, only to be advised "don't make any more movies."

Eventually Marcus Haupt, a former VP of Lehman Brothers, agrees to help but fails at clearly explaining these terms.

Harvard professor Kenneth Rogoff similarly fails.

Moore eventually concludes that the complex system and terminology are merely there to confuse and "get away with murder," and Wall Street is just "an insane casino."

Moore then explores the role of Alan Greenspan and the U.S. Treasury in leading up to the United States housing bubble that devastated the American middle class.

Moore also interviews a former employee at Countrywide Financial responsible for their VIP program for "FOAs" and details how many members of Congress and political figures received favorable mortgage rates under the program.

Moore then discusses with William Black, who analogizes the situation to the build-up of the collapse of a dam.

The film then shows the series of events leading up to the passing of the 2008 bailout proposed by Treasury Secretary Hank Paulson (also the former CEO of Goldman Sachs).

Moore then speaks with several Members of Congress, including Ohio congresswoman Marcy Kaptur, who agrees with Moore's comment that the passing of the bailout was a "financial coup d'état."

Moore interviews Elizabeth Warren, the head of the US Congressional Oversight Committee, the government agency serving as a watchdog for Congress' wrongdoing.

He asks her, "Where's our money?", referring to the $700 billion bailout money which Congress gave to the big banks and Wall Street investment companies.

Warren replies, "I don't know."

Advised by Warren to contact Paulson's office for answers, Moore's call is promptly disconnected upon recognition of his identity.

He then goes to Wall Street demanding to "get the money back for the American people", but is denied entry into every office building of the major banks.

The documentary features a number of positive portrayals, which include bailout watchdog Elizabeth Warren, Wayne County Sheriff Warren Evans, who put forth a moratorium on home evictions, and Ohio Representative Marcy Kaptur, who on the floor of the U.S. Congress encouraged Americans to be "squatters" in their own homes, and refuse to vacate.

The film also states that President Barack Obama's campaign caused only 37 percent of young adults to favor capitalism over socialism (although this claim was later disputed with support from youth polls by Fox News and the Pew Research Center).

The film then shows that in the year following Franklin D. Roosevelt's death (including TV footage of his proposed Second Bill of Rights) and the Allied victory in World War II, many of the defeated nations were given the rights proposed by FDR, but Americans were not.

The film then jumps ahead 60 years to show the devastation of Hurricane Katrina, which Moore suggests would have been less severe were it not for the economic system which made Wall Street rich while forcing residents of New Orleans to live in a poorly maintained neighborhood.

The film closes with Moore placing police lines around numerous banks, and lastly, Wall Street itself.

In his closing speech, Moore declares that capitalism is an evil which can only be eliminated and replaced with the goodness of democracy--rule by the people, not by money.

He asks all those who agree to "speed it up," referencing the aforementioned phrase by Don Regan to President Ronald Reagan during one of the latter's speeches.

A swing rendition of the Socialist anthem "The Internationale," sung by Tony Babino, a New York big band artist, plays over the closing credits.

Oginally thought to be a follow-up to the 2004 film Fahrenheit 9/11, it was revealed that Moore's film was to be a documentary about the financial crisis of 2007–2010.

In February 2009, he issued an appeal to people who worked for Wall Street or in the financial industry to share firsthand information, requesting, "Be a hero and help me expose the biggest swindle in American history."

In Capitalism: A Love Story premiered at the 66th Venice International Film Festival on September 6, 2009.

The film also screened at the Toronto International Film Festival on September 13 and at the New York Film Festival on September 21.

On September 23, the film had a limited release at two theaters in New York City and two theaters in Los Angeles, grossing $37,832 in its first day for a $9,458 per theater average.

The theater average was considered strong, though it did not beat the record opening of Moore's Fahrenheit 9/11, which grossed $83,922 at two theaters in one day.

Over the weekend of September 25, Capitalism grossed $231,964 in the four theaters.

The film had a wide release in 995 theaters in the United States and Canada on October 2, 2009, about a year after the enacting of the Emergency Economic Stabilization Act of 2008, which approved a $700 billion bailout of Wall Street.

The film opened in eighth place at the box office on the first weekend of its wide release, grossing $4,447,378.

The final domestic total was $14,363,397, making it the 16th highest grossing documentary in history.

Three months after a scene in which Moore approaches Goldman Sachs headquarters to reclaim taxpayers' funds, the bank was one of the ten that repaid part of the $68 billion received from the Troubled Asset Relief Program.

Moore responded to the action: "We're not talking about the majority of people who took the money ... not even 10 percent of the $700 billion has been returned."

Moore criticizes Wal-Mart for "dead peasant" policies, all 350,000 of which were cancelled in 2000. However, Moore notes that the termination of the policies was covered in the presentation of facts and quotes in the closing credits.

The documentary criticizes Senator Christopher Dodd and other government officials for benefiting from exclusive financial programs.

He lambasts Dodd in particular for predatory lending as chairman of the Senate Banking Committee.

The AP reported that the interest rates and fees involved were norms for the industry, and that the Senate's Select Committee on Ethics cleared Dodd and Kent Conrad of getting special treatments, but it cautioned the senators to exercise "more vigilance" with such deals.